Should You Hire a Tax Professional or File Your Own Taxes? Here’s What to Consider

- Tax Team

- Feb 8

- 3 min read

Updated: Oct 9

Which Option is Best for You?

Tax season can be overwhelming, whether you're an individual filer, a small business owner, or a freelancer. A common question many taxpayers ask is: Is it worth hiring a tax professional, or should I file my taxes myself?

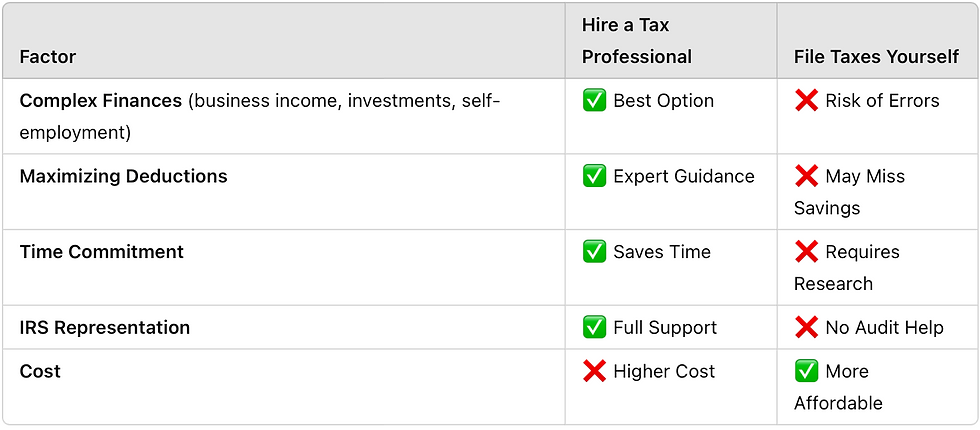

Each approach has its advantages, and making the right choice depends on your financial situation, tax knowledge, and time availability. Below, we break down the pros and cons of hiring a tax professional versus self-filing to help you determine the best option for you.

Why Hiring a Tax Professional is Worth It

A professional tax preparer can identify deductions, tax credits, and strategies that software alone might miss. If you're a business owner, independent contractor, or high-income earner, working with an expert can result in significant tax savings and better financial planning for the future.

2. Time Efficiency & Reduced Stress

Filing your own taxes can be time-consuming, especially if you have multiple income sources, investments, or self-employment earnings. The IRS estimates that the average taxpayer spends 13-24 hours preparing their return. A tax professional saves you time while ensuring your taxes are filed accurately.

3. Avoiding Costly Errors & IRS Audits

Even small mistakes on your tax return can lead to penalties, delayed refunds, or audits. Tax professionals double-check every detail to ensure accuracy, minimizing the risk of costly errors that could trigger IRS scrutiny.

Unlike tax software, a professional provides strategic planning beyond tax season. Whether you're looking to minimize liabilities, structure your business, or optimize your investments, a tax professional can guide you year-round to keep your finances on track.

5. IRS Representation & Support

If you ever face an IRS audit or tax issue, having a CPA or Enrolled Agent on your side can make a huge difference. A professional can represent you, handle IRS communication, and provide expert guidance to resolve issues quickly.

The Downsides of Hiring a Tax Professional

Cost: Hiring a professional can be more expensive than DIY software, but the potential tax savings and reduced risk of errors often outweigh the cost.

Finding the Right Expert: Not all tax preparers have the same qualifications. Make sure to work with a licensed tax professional, CPA, or Enrolled Agent.

Should You File Your Own Taxes?

1. Lower Cost for Simple Tax Situations

If you have a straightforward tax return, such as a W-2 job with no investments or deductions, tax software may be the most cost-effective option.

2. More Control & Financial Awareness

Filing your own taxes allows you to understand your finances better and stay hands-on with your income and deductions.

3. Free or Low-Cost Filing Options

Some taxpayers qualify for free tax filing through the IRS Free File program or low-cost tax software options.

The Risks of Self-Filing

Time-Consuming: Tax filing takes an average of 24+ hours for complex returns.

Higher Risk of Errors: Missing deductions, input errors, or misunderstanding tax laws can result in higher tax bills or penalties.

Limited IRS Support: If you face an audit, you’re on your own without professional representation.

Final Thoughts: Should You Hire a Tax Pro or DIY?

If you have a simple tax return and feel comfortable using tax software, self-filing may be a good option. However, if you have business income, multiple deductions, real estate investments, or want expert guidance, hiring a tax professional can save you time, money, and stress.

At Tax Team Services, we help individuals and businesses maximize tax savings, reduce liabilities, and ensure compliance. Whether you’re in Metro Detroit, Atlanta, Southwest Florida, or anywhere in the U.S., we offer expert tax preparation and remote filing services.

📅 Schedule a Consultation Today & Let Us Handle Your Taxes with Confidence!

Comments